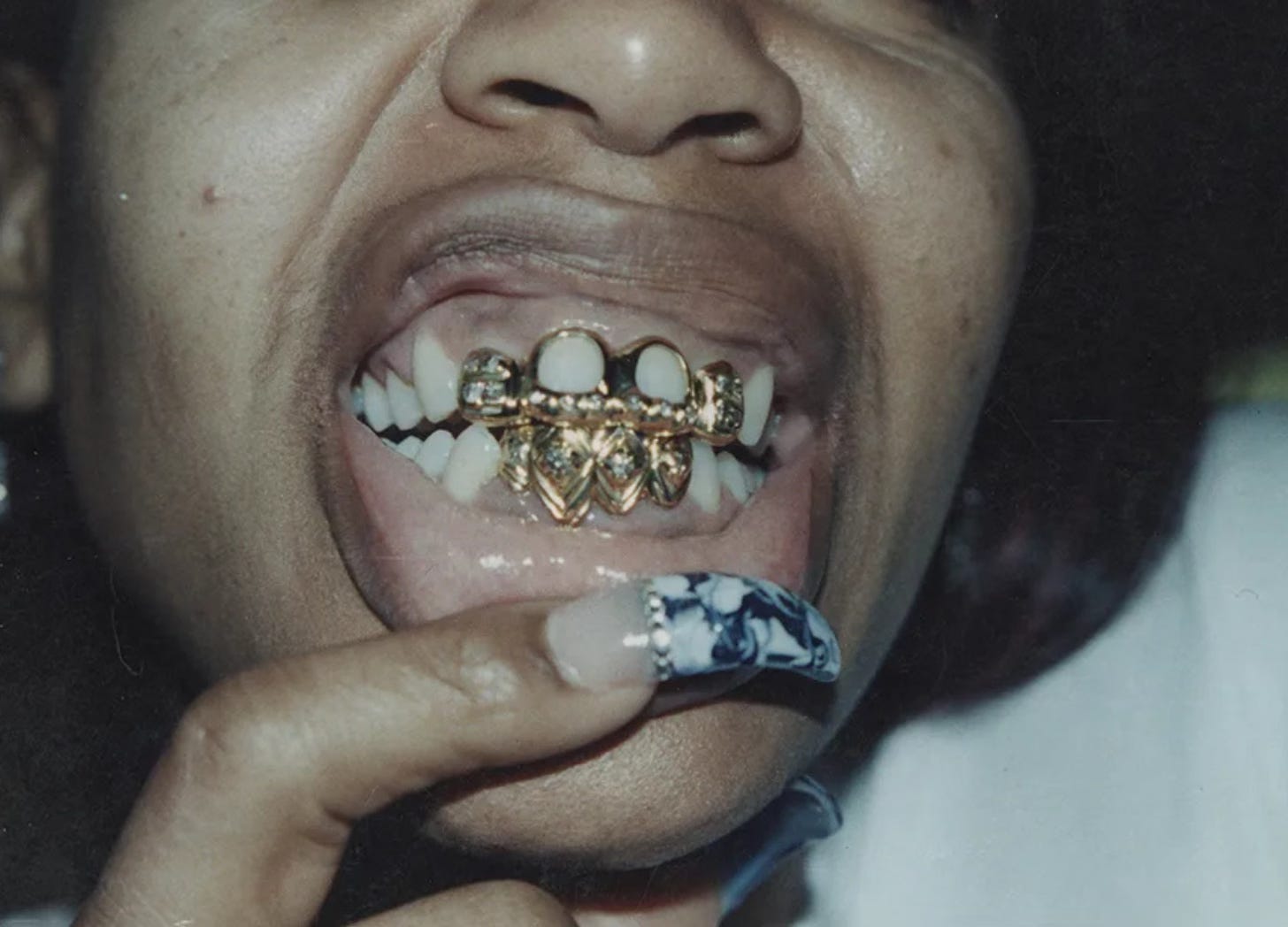

Going for gold

As economic jitters and geopolitical popcorn moments continue, gold is back in the headlines.

Gold prices are soaring, again. It’s back in the headlines, hitting historic highs and making everyone from central bankers to casual collectors suddenly pay a lot more attention to their bangles. But before we start melting down our heirloom earrings in a moment of financial genius, let’s take a beat. Why is gold doing what it’s doing? Hasn’t it always been expensive? And are there alternatives?

Gold has always been the drama queen of the periodic table. It’s been currency, jewellery, treasure, and the reason behind several small wars. In modern times, its price tends to leap whenever the world seems like a bit of a mess (so lately, pretty much constantly). In the late 1970s, gold hit the headlines during inflation spikes. In 2011, after the financial crisis, it broke records again. And now, as economic jitters and geopolitical popcorn moments continue, she’s back.

Should you be jumping on the gold train? Well, that’s up to you and your financial adviser. As for the alternatives, they might pique your interest more.

Watches: You knew this was coming. Vintage, limited-edition mechanical watches are becoming increasingly collectible, and occasionally – moon dust.

Artisanal jewellery: Not just gold, but pieces with provenance and design value. Particularly think of signed vintage pieces.

Luxury handbags: If it’s Hermès, and it’s in a box (especially if the box is blue) you might be holding something that beats the FTSE 100.

Gold will always be gold — it’s the Beyoncé of the asset world: iconic, reliable, and slightly out of reach. Whether you’re stacking sovereigns or scouring auctions for a rare Cartier Tank, the real luxury is knowing what you love might just quietly appreciate in value while you enjoy the sparkle.